States implement coordinated minimum wage increases Jan. 1

Read, Watch or Listen

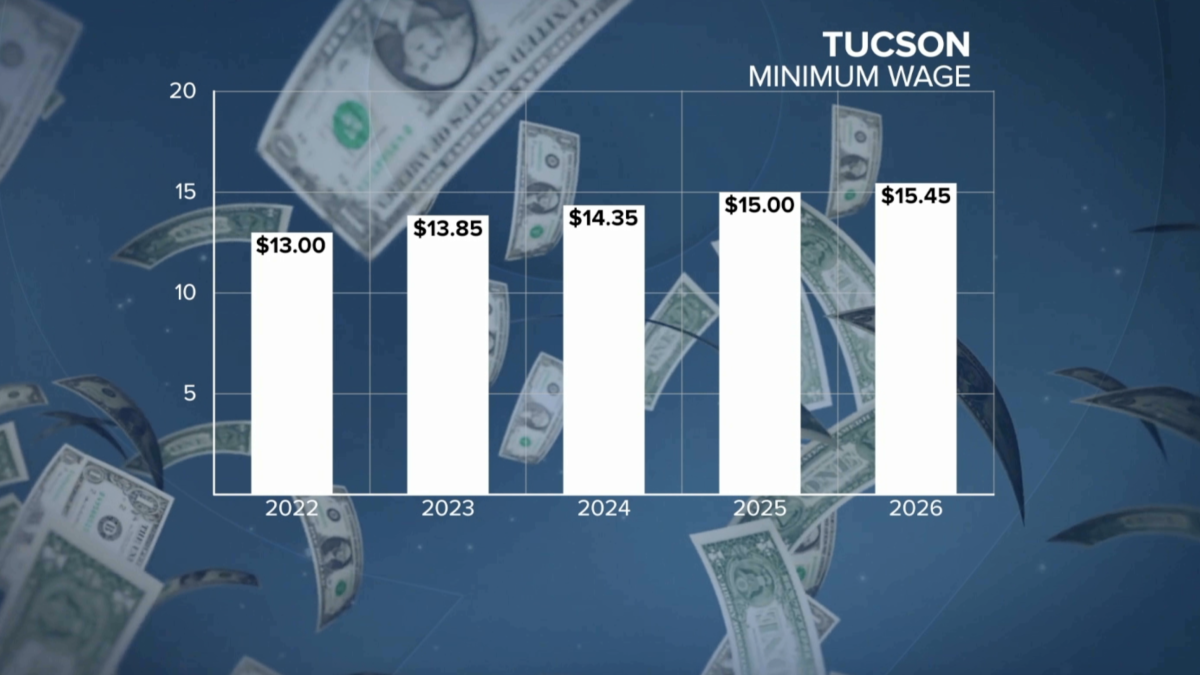

United States: State and local governments implemented minimum wage increases and related tax measures taking effect Jan. 1, 2026. Arizona raised its statewide minimum to $15.15 and Tucson to $15.45 under Proposition 206; Washington’s rate rose to $17.13 statewide and Seattle to $21.30; New Jersey increased to $15.92 for most workers and seasonal/small business rates to $15.23; Connecticut set a $0.59 raise under Public Act 19-4; Michigan enacted a minimum wage uptick alongside new gas and 24% marijuana wholesale taxes tied to an October road funding agreement. Based on 6 articles reviewed and supporting research.

Prepared by Christopher Adams and reviewed by editorial team.

Timeline of Events

- 2018–2019: New Jersey and Connecticut enact multi‑year minimum wage frameworks and laws tying future increases to CPI or statute.

- 2021: Tucson voters approve Proposition 206 establishing a local minimum wage and annual CPI adjustments.

- February 2025: Michigan lawmakers reach a compromise adjusting minimum wage rules and tipped wage provisions.

- October 2025: Michigan Legislature and governor agree a road funding deal including fuel tax and 24% marijuana wholesale tax.

- Jan. 1, 2026: States implement scheduled minimum wage increases and related tax measures across multiple jurisdictions.

- Articles Published:

- 6

- Right Leaning:

- 4

- Left Leaning:

- 1

- Neutral:

- 1

- Distribution:

- Left 17%, Center 17%, Right 67%

Low-wage employees in Arizona, Washington, New Jersey, Connecticut and other states receive statutory hourly wage increases effective Jan. 1, 2026, raising their legal minimum earnings.

Small businesses, seasonal employers and some service-sector firms face higher payroll costs, and Michigan consumers may pay more at the pump and via a new marijuana wholesale tax tied to road funding.

Coverage of Story:

From Right

Michigan gas tax, pot tax, minimum wage set to rise in the New Year

The Detroit News FOX 5 New York FOX 5 New York FOX 5 New York

Comments