Trump to Announce Fed Replacement After Rate Criticism

Read, Watch or Listen

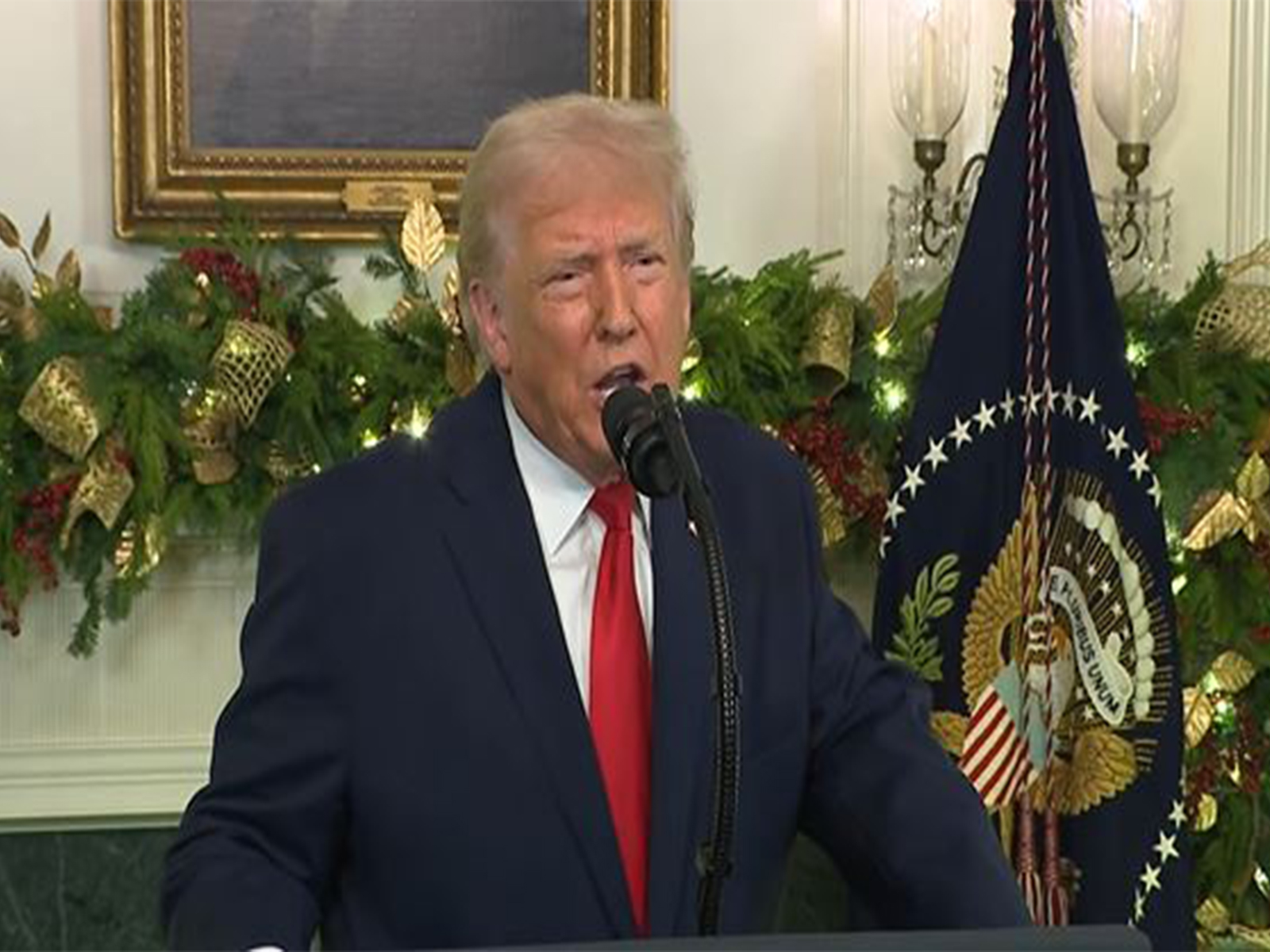

WASHINGTON — President Donald Trump sharply criticized Federal Reserve Chair Jerome Powell this week after the Fed voted 10-2 to hold its benchmark rate, urging that the central bank "substantially" lower rates and calling Powell a "moron" on Truth Social. Trump said higher rates raise government interest expense and tied his case to tariff policy, while his administration has pursued probes and called for leadership changes at the Fed. Powell's term ends in May and Trump said he will announce a replacement next week, with contenders named in public reports. Multiple outlets report. Based on 6 articles reviewed and supporting research.

Prepared by Christopher Adams and reviewed by editorial team.

Timeline of Events

- Late 2025: Fed cut rates at three consecutive meetings (as reported).

- 28th January 2026: Federal Reserve voted 10-2 to hold rates at 3.5%–3.75%; two dissenters favored cuts.

- 29th January 2026: President Trump publicly criticized Jerome Powell on Truth Social and at a cabinet meeting.

- 29th January 2026: Reports indicated the DOJ probe into Fed renovations and administration pressure on Fed officials.

- Trump announced he will name a new Fed chair next week; Powell's term ends in May.

- Articles Published:

- 5

- Right Leaning:

- 0

- Left Leaning:

- 0

- Neutral:

- 5

- Distribution:

- Left 0%, Center 100%, Right 0%

If the Federal Reserve cuts interest rates, borrowers and the federal government would pay lower interest expenses, reducing financing costs for households and public debt.

Sustained higher rates increase borrowing costs for households, businesses and raise government interest expenses on existing and new debt issuances.

Coverage of Story:

From Left

No left-leaning sources found for this story.

From Center

Trump to Announce Fed Replacement After Rate Criticism

Free Malaysia Today LatestLY Ommcom News The Korea Times The StarFrom Right

No right-leaning sources found for this story.

Comments