Florida lawmakers begin session amid property tax debates

Watch & Listen in 60 Seconds

60-Second Summary

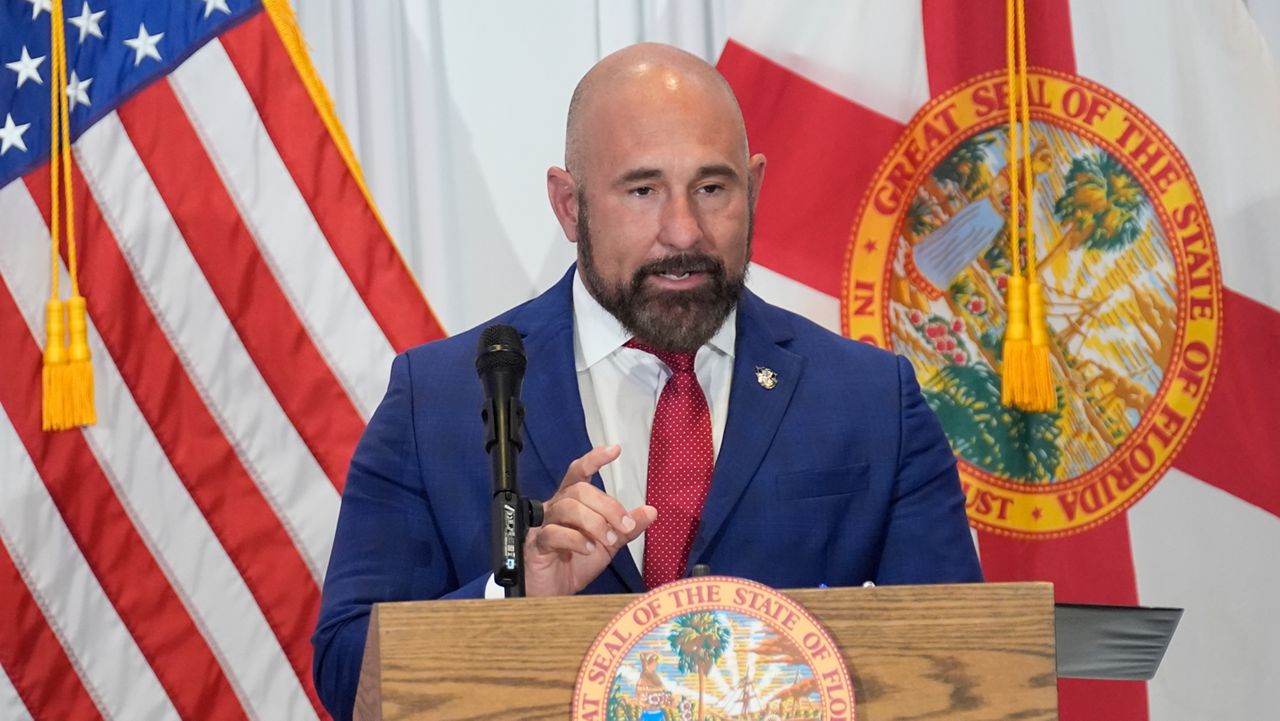

TALLAHASSEE — Florida lawmakers opened the 60-day legislative session Tuesday as Governor Ron DeSantis delivered his final State of the State address outlining priorities including property tax changes, insurance reform and an AI Bill of Rights. Lawmakers introduced multiple bills that would eliminate or reduce non‑school property taxes, some moving toward ballot referendums. Local officials warned the measures could cut vital revenue that funds police, fire and schools; some bills include provisions protecting law enforcement and school funding. DeSantis and officials also cited insurance premium declines and a corporate tax combined-reporting proposal. Based on 6 articles reviewed and supporting research analysis.

About this summary

This 60-second summary was prepared by the JQJO editorial team after reviewing 6 original reports from News 13, 7 News Miami, Spectrum News Bay News 9, https://www.wctv.tv, FOX 13 Tampa Bay and Curated - BLOX Digital Content Exchange.

Timeline of Events

- December: Governor DeSantis proposed an AI Bill of Rights.

- Late 2025: Multiple property-tax relief bills were filed ahead of the session.

- A House committee advanced four bills proposing elimination or reduction of non-school property taxes.

- Monday: Governor DeSantis held a Davie press conference citing insurance premium declines and previewing session priorities.

- Tuesday: The 60-day legislative session opened with the governor's State of the State address amid leader tensions.

- Articles Published:

- 6

- Right Leaning:

- 2

- Left Leaning:

- 0

- Neutral:

- 4

- Distribution:

- Left 0%, Center 67%, Right 33%

Homeowners, particularly those with homesteaded property, would gain reduced property tax burdens and potential direct financial relief if proposed non-school property-tax eliminations or exemptions pass.

Local governments and school districts would suffer significant revenue shortfalls that risk reducing funding for police, fire, EMS and education or require alternative financing.

After reading and researching latest news.... Florida's session centers on property tax rollback proposals, insurance reforms, and AI policy. Proposed non-school property-tax eliminations could materially reduce local revenue funding public safety and schools; several bills include protections for law enforcement and education to mitigate fiscal impacts later this year.

Coverage of Story:

From Left

No left-leaning sources found for this story.

From Center

Florida lawmakers begin session amid property tax debates

News 13 7 News Miami Spectrum News Bay News 9 https://www.wctv.tvFrom Right

Property taxes take center stage as Florida lawmakers kick off legislative session

FOX 13 Tampa Bay Curated - BLOX Digital Content Exchange

Comments